Fund your startup or small business at 0% interest for the first 12 months.

The process is simple, 700 credit score or better gets you funded

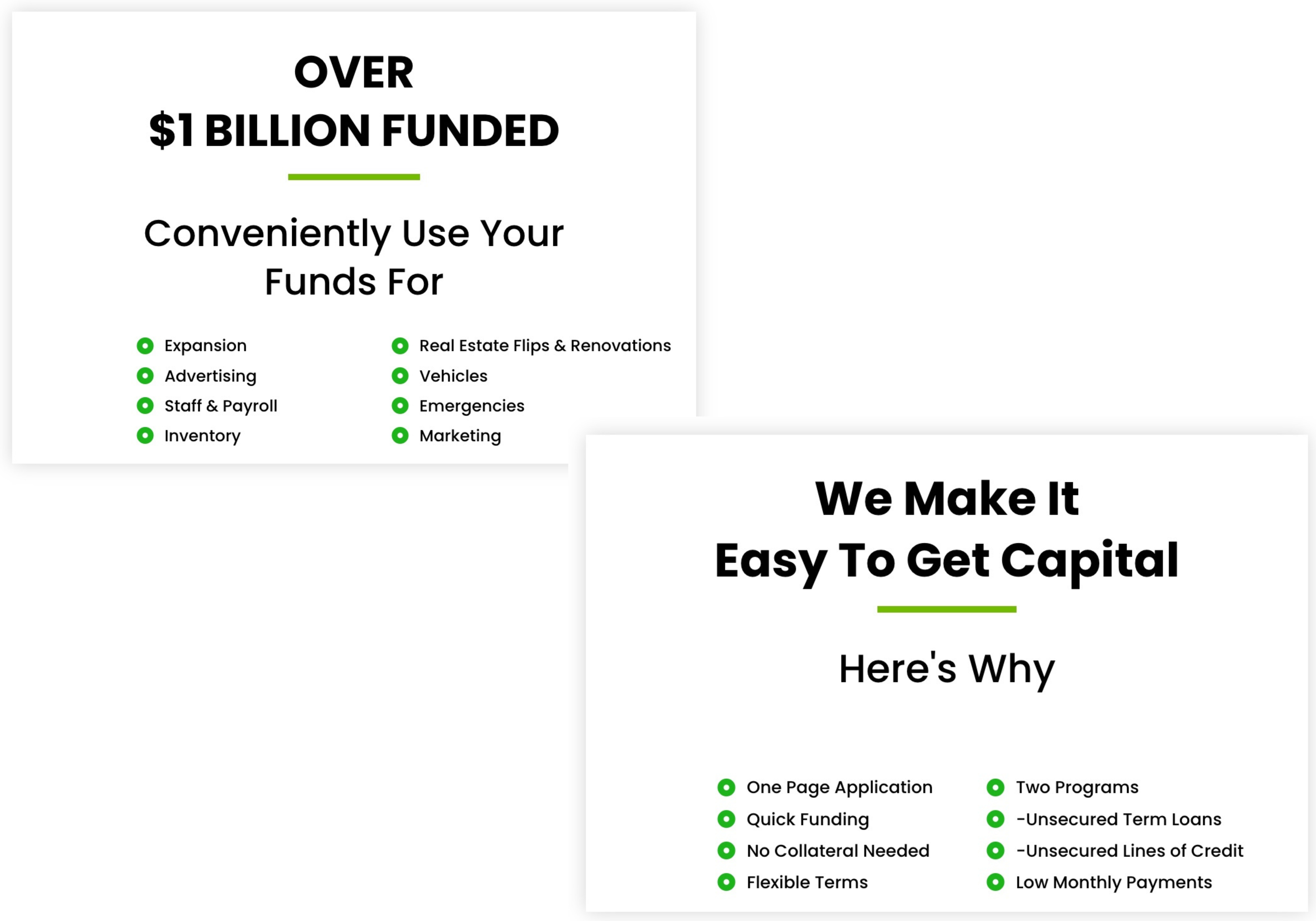

for your dreams of owning a business. We have the tools to make

sure you can become a business owner today.

What you need to apply:

- Credit report from all three bureaus. Experian, Transunion, Equifax If you do not have an account with a third party that can provide a report, we recommend using MyScoreIQ

- Personal and business tax returns for the last 2 years.

- Your business's last 6 months of bank statements.

Start your application here Start

Frequently Asked Questions

DO YOU WORK WITH NEW ENTREPRENEURS?

Absolutely. We work with many new founded businesses. As a new

startup founder, it’s important to get yourself around the right

strategic partners who can give you the right advice, expertise,

and outcomes. We’re that partner for you. You’ll learn about the

best funding options available to you as a new business owner.

These options coupled with the alignment of our experience and

your goals you’ll be able to grow faster and more responsibly.

HOW LONG DOES THE FUNDING PROCESS TAKE?

Our process takes 7-10 days from application to approval to

deposit. Keep in mind our process is fully done for you so you can

sit back while we do all the heavy lifting for you.

ARE THESE HIGH INTEREST RATE LOANS?

Not at all. High rate short-term loans have become very popular

over the past few years. We do not offer what we would not use for

our own business. You’ll never have to worry about those types of

expensive financing options with us.

WHAT BUSINESSES ARE A GOOD FIT?

We serve many industries. The medical and dental industry has

great results with our programs. While real estate investors, new

business owners, and even online e-commerce businesses benefit

greatly from our funding options.

WHAT ARE THE INTEREST RATES?

The interest rates are traditionally priced and are actually some

of the lowest in the industry for unsecured financing options. The

range of rates on the Term Loans are between 3.99% – 12.99% The

range of rates on the Business Credit Lines are between 5.99% –

14.99% but come at an introductory rate of 0% for the first 6-18

months. Interest rates are based on the strength of your personal

credit score and payment history.

WILL YOU HELP ME AFTER I GET FUNDING?

Yes, and you’ll receive unlimited ongoing support from our team.

Now only will you get funding for your immediate business needs

but you’ll learn how to best manage your new funding while you

work with us to grow those funding sources over time with our

ongoing support features. Our goal is to help you get the most of

our programs and avoid the mistakes that come with attempting to

do it on your own.

CAN I COME BACK FOR MORE FUNDING?

On average, our clients will return to us on 3-4 separate

occasions to apply for more funding.